Well, heck. It was fun while it lasted. Or, yawn, wake me when something important happens. Chances are, one of these reactions is relatable to you when it comes to the recent stock market volatility. While most experts knew that day after day record high Dow Industrials are not sustainable, no one was expecting…this! If you have a financial advisor, one of two things is happening. Either you’re getting nightly emails begging you to not panic. Or, he’s “out of the office and away from his phone.” All of this leads Gildshire to some questions. Are we headed for an epic market crash? If the answer is yes, what should we do to prepare?

“Is an epic market crash inevitable?”

A market correction from the giddy-high late 2019 bull rush is/was inevitable. A happy convergence of high profits and improved international trade relations bore the market upward at a dizzying rate. Each and every morning, your 401k woke you up for a hug. Birds sang, and bees buzzed…and it was December!

That kind of thing could not continue. So, a gentle reverse wave was due. Only then, everybody started getting sick with a new strain of coronavirus! If not everyone, at least enough that precautions were necessary. The precautions turned out to have international implications. Long story short, the planes stopped flying, and the flow of money stalled. The international economy is dependent on money changing hands. The stock market, instead of slowly pushing back against last year’s gains, started bowling us over like a running back against a kicker! A bad day at the market was followed by a worse day. One good day was sandwiched by two “Oh, crap” days.

“So you’re saying this will all be over when we get a handle on the coronavirus.”

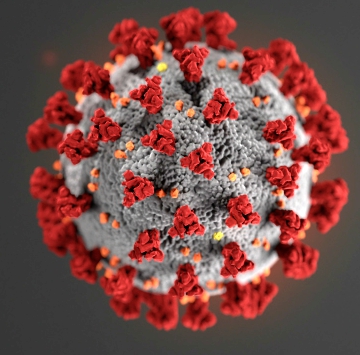

Closeup of the Coronavirus molecule. Will this thing cause an epic market collapse?

Probably, yes. But, no one knows when that will be or how much of a toll it will take. The people in the highest seats of power no little to nothing about pandemics. So you can’t believe a word that comes out of Washington unless it has the letters CDC attached.

“What is the CDC?”

That’s the Center for Disease Control. Everyone else is just guessing.

“Okay, so what should I do if this turns out to be an epic market crash?

First, remain calm and think of a downturn as “stocks on sale.” If you were at the mall and heard an announcement that everything was 25% off, you would say, “Whoo-hoo!” When stocks go down, it is time to max out an IRA or put more in a brokerage account. Some of your favorite stocks have declined. (Unless you are extraordinarily lucky.) That’s okay. Add to your positions. Here’s the deal. The stock market can be a stressful place. But if you invested soundly, your investments will always deliver over the long haul. So if the U.S. stock market takes a dive this year, you should take a deep and cleansing breath. You’re no day trader. (Unless you are. Then we need to talk!) You’re an investor with an eye to the future.

“That sounds fair. So, what is the second thing I should do.”

Nothing. I know your goal is to buy low/ sell high. But in a volatile market, our emotions take off on us. Our basic instincts tell us to, “Sell, Sell” with the sinking market. “Before things get any worse,” we tell ourselves. That’s the opposite of what we should do. Take a deep breath and look for bargains.

“Do you have a real-life example?”

Yes, I do. The auto industry was hard hit during the 2007/08 recession! At the bottom of the market, Ford was selling for a little over a buck a share! We jumped in. A year later, Gildshire sold our Ford stock for $12 a share.

“Okay, those are two good ideas. Do you have a third?

We always have good ideas, but that’s enough for now. Just try not to let the late-night panics win the day. As of today, we are not predicting an epic market crash. But we are predicting that you will weather the storm, and profit down the road. You read Gildshire, so that makes you a pretty smart cookie.